Ukraine’s Long-Term Road to Recovery

When Ukrainian President Volodymyr Zelenskyy visited a liberated Kherson city in southern Ukraine in mid-November, he declared that Ukraine’s victory there marked “the beginning of the end of the war.” Though much remains to be seen, President Zelenskyy’s words highlight the importance of thinking about rebuilding Ukraine after the war ends.

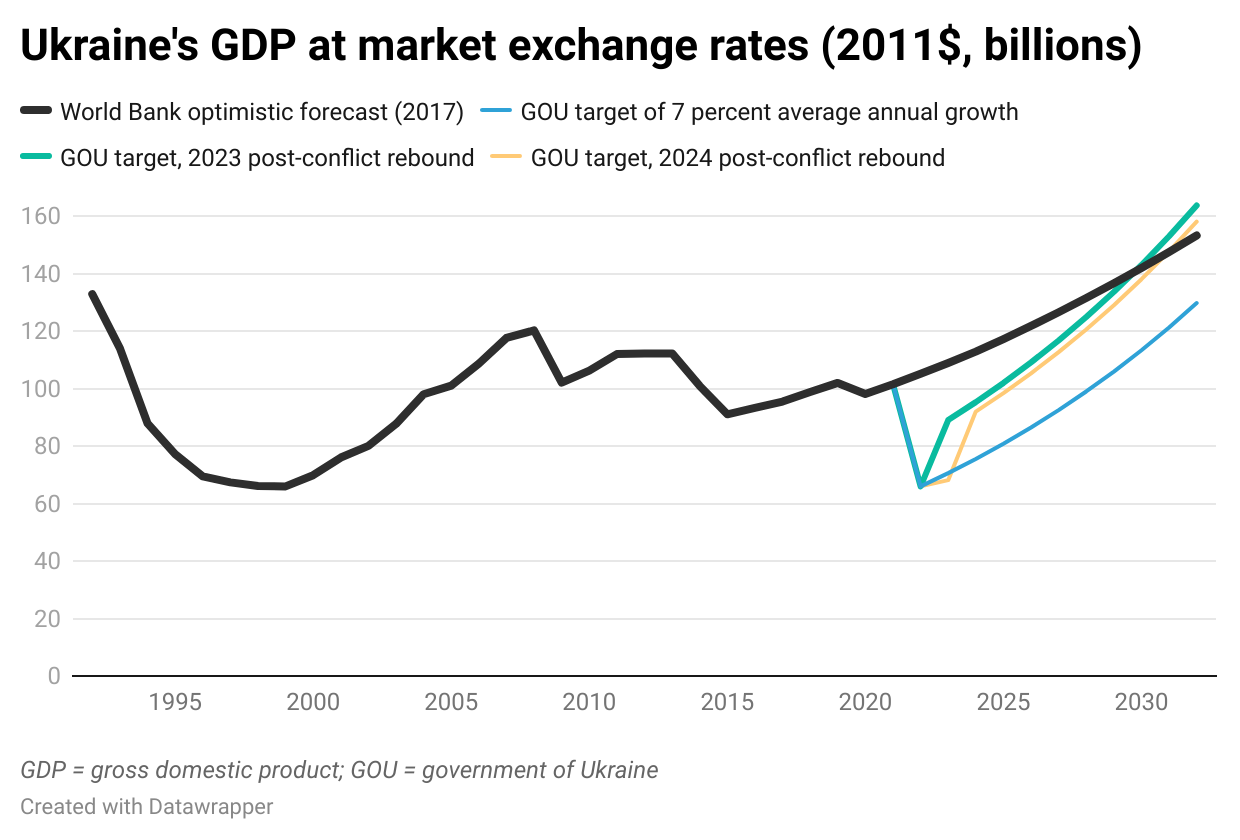

To that end, the Ukrainian government has been persistent in developing and maintaining post-conflict recovery plans. Kyiv’s top-level goals include 7 percent average annual gross domestic product (GDP) growth through 2032, $750 billion in accumulated investment during that time, net positive inward migration, and a substantial shift away from fossil fuels to reduce reliance on coal, natural gas, and oil from two-thirds of Ukraine’s energy supplies today to a little over one-third within a decade.

The government’s goals are undoubtedly ambitious — but also achievable with ample, sustained Western aid and a little luck. The exact level of ambition will depend on the course of the conflict and the timing and strength of rebounds in Ukrainian production, consumption, and investment. The roughly $100 billion in Western aid to Ukraine to date has helped further these goals, but Ukrainian perseverance is likely to require billions of dollars in additional aid per month, according to the International Monetary Fund. And Ukraine’s success will likely to bring with it a new challenge: a managed Russian decline and thinking ahead about how Moscow may demand positive economic inducement from the West to negotiate a lasting peace.

A Protracted War

An evaluation of Ukraine’s long-term recovery prospects must start with a consideration of the likely trajectory of the conflict. Although no one can say for certain, and a sudden collapse of the Russian military is a possibility, many signs point toward a protracted conflict. From a broad conceptual perspective, this is due to both the Ukrainian and Russian sides maintaining secure conditional viability, or a situation where substantial resources — in Ukraine’s case, Western economic, military, and intelligence support; in Russia’s case, sizeable arms stocks and a nuclear arsenal — make it unlikely that the conflict will end in outright victory for either side.

Senior U.S. military officials and outside analysts’ assessments of the situation appear to support this notion, as suggested by Chairman of the Joints Chiefs of Staff Gen. Mark Milley’s assertion that “the probability of a Ukrainian military victory, defined as kicking the Russians out of all of Ukraine, to include what they claim is Crimea… is not high, militarily.” And indeed, President Zelenskyy has made clear that victory from his perspective would include a retaking of Crimea and the Donbas along with territories occupied by Russia since February 24, 2022.

Russian President Vladimir Putin, meanwhile, has passed two “points of no return,” according to Michael Kofman, research program director in the Russia Studies Program at CNA: the recent referenda illegally annexing additional Ukrainian territory and a mass mobilization of up to 300,000 (though likely somewhat fewer) Russians this fall. In other words, neither the Russian nor the Ukrainian side appears intent on backing down any time soon. According to Kofman’s best guess at present, the war could last for another year from this point.

How Russian and Ukrainian military strategies evolve in the coming months will also likely affect the war’s duration. According to some of the best statistical models, a shift toward a “punishment strategy” by either side — that is, where one force seeks to inflict high costs rather than to outmaneuver or attrit opposing military forces — should be expected to increase the war’s duration by roughly three to nine months relative to non-punishment strategies and holding other factors equal. Recent persistent Russian attacks on Ukrainian infrastructure are an indicator of such a shift.

Recovery Goals

A protracted conflict will have a direct impact on Ukraine’s recovery goals. Much will depend on GDP growth, which, although an imperfect measure, will offer a good approximation of the strength of Ukraine’s recovery. Already, Ukraine has vastly exceeded expectations on this front. In April 2022, the World Bank predicted that Ukraine’s economy would contract by 45 percent in 2022. The World Bank’s October revision reduced this figure by 10 percentage points to 35 percent — a devastating loss but a full $20 billion of additional economic activity that earlier projections had written off.

Unfortunately, the World Bank’s latest forecast for 2023 projects that Ukraine’s economy will grow at only 3.3 percent next year. Considering the much lower base value (i.e., an economy that is only two-thirds of its pre-war size), this would be bad news for Ukrainians. Although no perfect comparison exists, a much healthier recovery would be similar to the rebounds seen in Libya in 2012, which saw an economic contraction of 50 percent in 2011 followed by 86 percent growth in 2012, or in Iraq in 2004, which saw a contraction of 36 percent in 2003 followed by 53 percent growth in 2004.

What Ukraine of course does not want to see is a growth trajectory more similar to Syria or Yemen following the initiation of their ongoing conflicts. Syria experienced double-digit economic losses for several years following the outbreak of war in 2011, returning to positive growth —an anemic 1.4 percent – in 2018. Yemen similarly has only seen positive economic growth in four of the past 10 years, setting back its human capital development by two decades.

If history is any indication of the past, a positive sign for Ukraine’s ability to reach the government’s target of 7 percent average annual growth for the next decade is that it has done so before. Although a very different time for the country, the period from 2000 through 2008 saw the beginning of Ukraine’s recovery from its post-Soviet economic contraction, with 6.9 percent average annual economic growth in those years. This growth was ultimately hampered by domestic dysfunction, including corruption — which serves as an important reminder that the government’s objective to “tackle corruption” will be critical for Ukraine’s long-term growth prospects.

If next year or in 2024 Ukraine experiences a growth rebound typical of other post-conflict countries and thereafter meets government targets, the results would exceed the more optimistic pre-war forecasts, including those from the World Bank and its partners at the Ministry of Economy, Ministry of Finance, and National Bank of Ukraine in 2017. In this case, the war would prove to be an opportunity for both democratic and economic renewal.

Meeting government targets for overall economic growth will require that a series of other targets be met, including long-term growth by 2032 (relative to 2019 values) in agriculture and — to a lesser extent — energy, metallurgy, and information and technology exports. While several major wheat and millet producing areas in Ukraine remain contested territory, the majority of its primary barley, corn, rapeseed, soybean, and sunflower seed producing areas remain in Ukrainian control. Although 2022 crop production is estimated to have amounted to two-thirds of 2021 production, Ukraine’s ample grain stocks have buffered exports in recent months. Land tenure reform and an increased focus on high-value-added products have the potential to bring substantial long-term growth to Ukraine’s agriculture sector despite possible losses of territory. Continuance of the Black Sea grain deal allowing for the shipment of agricultural goods from Ukrainian ports will of course remain critical and require sustained cooperation from an otherwise difficult partner in Ankara.

Household consumption will likely contribute less to Ukrainian GDP in the near term given that nearly one-fifth of Ukrainians are estimated to have fled the country since February 2022, making the government’s targets for net inward migration through 2032 critical for long-term growth. Despite early estimates that remittances to Ukraine would increase by 20 percent in 2022 relative to 2021, they appear to have remained largely unchanged, growing only by 2 percent according to more recent World Bank estimates. For those who remain in Ukraine, inflation will continue to reduce purchasing power, although the National Bank of Ukraine noted in November that inflationary pressures appeared to have begun easing. Additionally, the majority of Ukrainian household savings were in foreign currencies in the years before the war. Assuming this pattern has held, then domestic inflation will have less of an impact on purchasing power than might otherwise have been the case.

Perhaps most critical will be continued foreign aid. As the conflict progresses, Ukraine’s national budget deficit continues to grow. The government has set a target of a quarter of a trillion dollars in foreign aid over the next decade. While ambitious, financial aid commitments to date have approached the government’s 2022 target of $60 billion.

Other Building Blocks of Recovery

Whether Ukraine is successful in achieving these goals will have substantial implications for whether it is likely to maintain net positive inward migration in the coming years. Strong economic growth, along with improved security, would encourage Ukrainian refugees to return home — something that would in turn be expected to boost Ukraine’s economic growth. In other words, a strong initial recovery can initiate a virtuous cycle, ultimately resulting in a Ukraine that would, for example, likely graduate from lower-middle to upper-middle income country status. In such an instance, Ukraine would also likely see its economic competitiveness and innovation near the levels of many high-income countries — another top-level goal for the government.

A similar feedback loop can be expected with investment, where investment directly drives growth and signals confidence in the economy, and confidence in the present begets confidence in Ukraine’s future. As such, early growth figures may provide an indication of likely future investment. The sooner investment returns, the longer there will be for gains to compound and growth to accumulate.

Yet, Ukraine’s road to recovery will become increasingly difficult the more effective Russian troops are in destroying Ukraine’s critical infrastructure, particularly that related to energy. Indeed, energy consumption is often relied upon as an alternative to, or a means to validate, GDP growth figures, which can be subject to manipulation and difficult to estimate amid major shocks. This is for good reason: without electricity, it is hard to get work done. Unfortunately for those desiring a shift away from fossil fuels, Ukraine may need to rely on whatever energy sources it can get, including potentially an increased reliance on coal.

Conclusion

What to watch for in the days and months ahead will be Western — especially American — support for Ukraine. Despite substantial support to date, Ukraine maintains a dire need for additional recovery funds, including a recent request for $17 billion in economic relief. As many inside and outside Ukraine have warned, support to get through this winter will be especially critical. Yet, in the long run, Western aid donors will need to strike a balance between support for recovery efforts and an accidental fostering of aid dependence, which would likely suppress long-term growth.

In the meantime, Ukraine’s supporters should temper hope with modest expectations. While it is plausible that Ukraine could embark on a decade-long recovery trajectory that is ultimately stronger than its pre-war path, it is too soon to say whether such a recovery is probable. Even in the better potential scenarios for Ukraine, Western leaders may need to consider post-conflict support for Russia as well, along with potential (admittedly controversial) off-ramps to end the conflict. This approach of pairing deterrence with assurance may be unpalatable, but Russia faces serious economic and demographic challenges ahead, and officials will have to consider how economic inducement could be used to kick-start or sustain peace negotiations. Ukraine’s economic recovery hinges on a return to normalcy and an end to the fighting. Moscow is, almost certainly, going to try and wrest concessions from the West if and when it chooses to consider ending the war.

Ukraine faces a daunting challenge in rebuilding its society. However, with the right mix of economic aid, fairly self-evident policy remedies, and some luck with GDP growth, Kyiv can meet its targets.

Collin Meisel is the associate director of geopolitical analysis at the University of Denver’s Frederick S. Pardee Center for International Futures at the Josef Korbel School of International Studies and a geopolitics and modeling expert at the Hague Centre for Strategic Studies.